Why You Need a Certificate of Insurance for a Home Project (and What It Needs to Include)

Planning on working on a home project soon?

You certainly are not alone. We’ve seen it a lot in the past year. Those who have been fortunate enough to not experience job loss or other negative financial impacts from the 2020 COVID-19 pandemic may even have some extra money from vacation savings or stimulus checks that they can now put towards home improvement projects or perhaps building their dream home.

But regardless if you’re planning a home project in the immediate future, or ten years from now, you need a certificate of insurance (COI) from the contractor doing the work. If you don’t know what that is, we’re here to help!

At Berry Insurance, we’ve helped several clients prepare for their home projects by getting a COI -- but we also understand that it isn’t something most people are familiar with, so we’ve also helped them determine what they should require and look for on a COI.

In this article, we’re going to do the same for you. Below, we’ll define a COI, let you know what you should request from your contractor on it, and tell you what to look for when actually reviewing the document.

Table of Contents:

- What is a COI?

- Why do I need a COI for a home project?

- How to get a COI

- Types of insurance and limits the COI should include

- Sections of the COI to look out for

What is a COI?

A certificate of insurance is a slip of paper (a digital or printed document), proving someone has insurance coverage.

These could be for any type of business insurance, but are most often needed for general liability or workers compensation insurance.

The COI outlines details about an insurance policy including company name, insurer name, type of insurance, policy numbers, policy effective dates, and coverage limits.

Essentially, the COI serves as a proof of insurance so you know any contractors or business you are working with has the insurance protections essential to minimize risks. It serves as a peace-of-mind before entering into a business agreement.

Why do I need a COI for a home project?

If you’re completing a home project of any kind, you absolutely need to get a COI from the contractors you’re working with.

The purpose of acquiring a COI is to make sure the person doing the work has appropriate insurance coverage for that work. That way, in the event of a claim, the contractor’s insurance will essentially respond and protect you as the homeowner from a claim being made against you.

If the subcontractor didn’t have adequate insurance and there was a claim, you could end up needing to pay. And we’re going to assume you don’t want to pay a large out-of-pocket expense on top of the expensive home project you're already paying for.

How to get a COI:

To get a COI for a home project, there really isn’t a lot you need to do. You simply need to ask the contractor doing work on your home to get a COI from their insurance company or agent, showing that they have the types of insurance and limits you want them to (which we’ll get into more below.)

The contractor or company you are working with will then need to contact their commercial insurance agent and provide them with your name, address, and insurance requirements.

If the contractor already has the proper coverage, the agent will issue the COI for the contractor to give to you.

If their insurance coverages do not meet your requirements, they can either buy the extra coverage, or decline to take on the job for you.

We’ve also seen some contractors work out a deal with the homeowner to buy the extra coverage, if they can add the cost of it to the price of the job they are completing. So in this case, you would be paying for the coverage, but it may be worth it for your protection (and preventing you from looking for another contractor.)

Types of insurance and limits the COI should include:

So I’m sure you’re wondering “What types of insurance and how much insurance should I require?”

As a homeowner, you probably aren’t too familiar with business insurance and aren’t comfortable knowing what types of insurance and what coverage limits to require of people working on their home.

You want to be fully protected, but you also don’t want to have unreasonable insurance requirements.

Well, some of these requirements depend on your specific project, but we can give you a few recommendations.

General liability insurance:

General liability insurance is a type of business insurance policy that covers claims made against your contractor and his business from someone who experienced bodily injury or property damage.

This policy would kick in if your contractor causes damage to your property or injury to you or a family member. Without making sure they have enough coverage, you could be stuck paying for those repairs/injuries.

We recommend you make sure your contractor have at least $1 million in liability coverage.

Commercial umbrella insurance:

Sometimes known as an excess liability policy, commercial umbrella insurance supplements a business’ existing general liability insurance, commercial auto insurance, and workers compensation insurance. If a large claim exhausts their underlying coverage, the business umbrella insurance will cover the rest, up to the limit on the policy.

Depending on the value of your home, and your comfort level, you may want to make sure your contractor has an umbrella policy.

For example, if you have a home worth more than $1 million dollars, it may be a good idea to have at least $1 million in umbrella insurance (the minimum) to supplement the general liability policy.

If your house is under a million and you feel comfortable with it, you might be ok with your contractor not having an umbrella, but keep in mind, beyond the value of your home, you also have to be concerned about your home’s contents, and injury liability.

To make sure your contractor has the right insurance for you specific project, you may want to reach out to your insurance agent, so they can provide you with more individualized guidance.

Workers’ compensation:

Workers’ compensation insurance covers medical payments and a portion of lost wages for employees who become injured or ill due to work-related causes.

If a contractor working on your home gets injured on the job and he isn’t covered by workers compensation, he could sue you for injuries.

Limits for workers’ comp can vary depending on the work being completed. We typically recommend at least $500,000, but if you have questions, definitely check with your agent.

You also need to make sure no contractors are excluded from the policy (more on that below.)

Commercial auto insurance:

Much like personal auto insurance, commercial auto insurance protects against damage and injury liability when driving, except it applies to business vehicles.

While this coverage isn’t usually necessary for a home project, you may want to consider including this as an insurance requirement if you want to ensure protection to any materials being transported to your home.

Sections of the COI to look out for:

When you finally have the COI from your contractor in hand, you’ll want to review it, checking for certain items to confirm everything is correct and you are in fact properly covered.

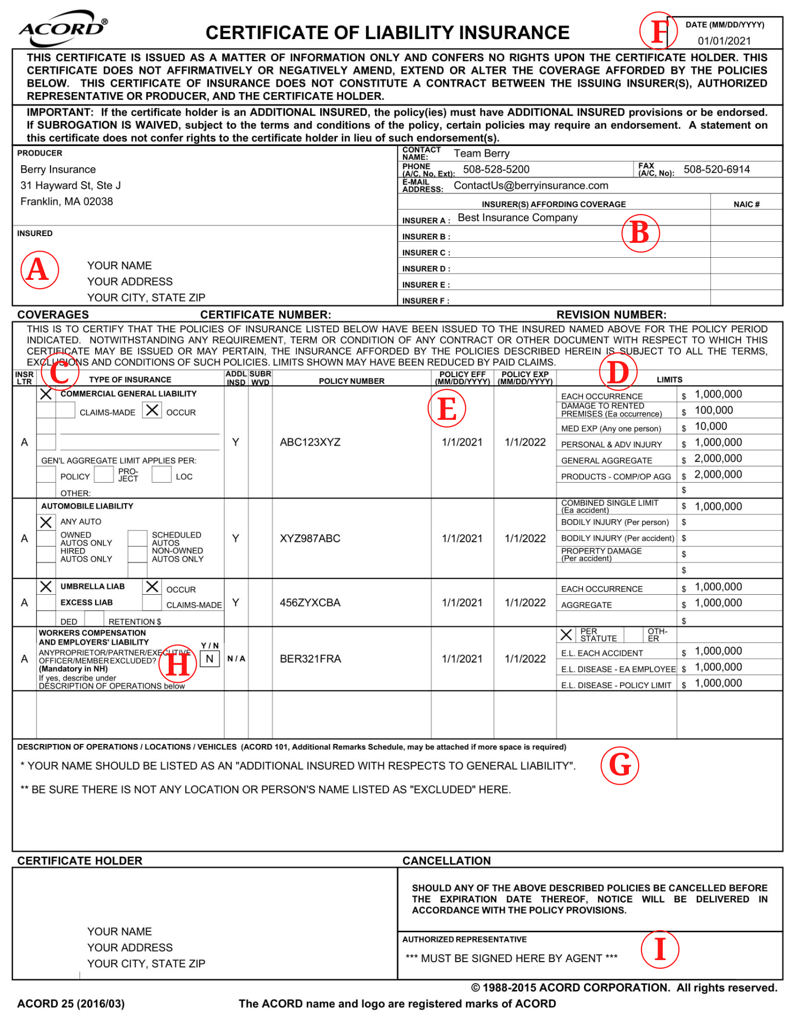

For this section, we’ve included an image of what your COI may look like. Follow along by looking for the letter corresponding to each section on the image.

A. Named insured: This section should include the name of the contractor.

B. Insurance company: This section shows the insurance company your contractor has the business insurance policy through. Sometimes, there may be more than one insurance company listed. This just means they have different carriers for their different types of insurance. You’ll want to look at the insurance types section to make sure the correct policies correspond with the correct carriers.

C. Insurance types: This section shows the types of insurance the COI is proving insurance for. You will want to check here to make sure it includes all the types of insurance you are requesting.

D. Limits: Across from the insurance types, you’ll see the policy limits associated with each type of insurance. Again, make sure these limits match the amount you requested.

E. Policy effective date: This section shows the term of the commercial insurance policy, meaning when it started, and when it will expire. If you expect your home project to extend beyond the expiration date, you’ll want to make sure the contractor or company renews their policy and you get a new COI from them.

F. COI date issued: The date issued shows the date the COI was created, so for one, you’ll just want to double check that the date is correct and within the policy effective period. You’ll also want to note that a COI is only a snapshot in time, meaning that it can only prove insurance was active on the issue date. Theoretically, a contractor could get a COI as proof of insurance, then cancel the policy the next day. (We’ll get into what to do about that in section G.)

G. Special conditions: This section is where the agent should list the property address for the job, and any job details or your special requirements. We recommend to our clients that they be listed as an "additional insured" in this section to protect them against liability lawsuits. If you are listed as an additional insured, you will usually be notified if the policy cancels, leaving you unprotected.

H. Workers’ compensation: Under the workers’ compensation section, there will be a check box indicating whether the owner is included under the policy. Sole proprietors and officers of corporations can opt out of workers’ comp coverage, so the check box will show you whether they are included or not. There may also be language about it in the special conditions section if the owner is not included. If this is the case, you should require they not be exempt from the coverage -- anybody working on your home should have workers compensation coverage.

I. Signature: And of course, you will want to make sure the document is signed by the contractors insurance agent, indicating that it is official.

Pursue your home project with confidence:

While getting a COI may seem like a nuisance step holding you back from moving forward on your highly anticipated home project, it is a crucial part of the process.

All home projects come with at least some degree of risk, so you need to protect yourself with a COI and you need to know what to include and look out for on that COI so your project can be finished effectively and without any unexpected legal situations.

We see the importance of it quite often. At Berry Insurance, in addition to helping homeowners get and review COIs, we’ve also seen home project claims situations that could have turned ugly if the homeowner didn’t get a COI to ensure the contractors had adequate coverage.

But before you before you begin your project, know that ensuring that the contractors have the right coverage might not be enough. Check out this article to learn if you could need builders risk insurance for your home project.

.jpg)