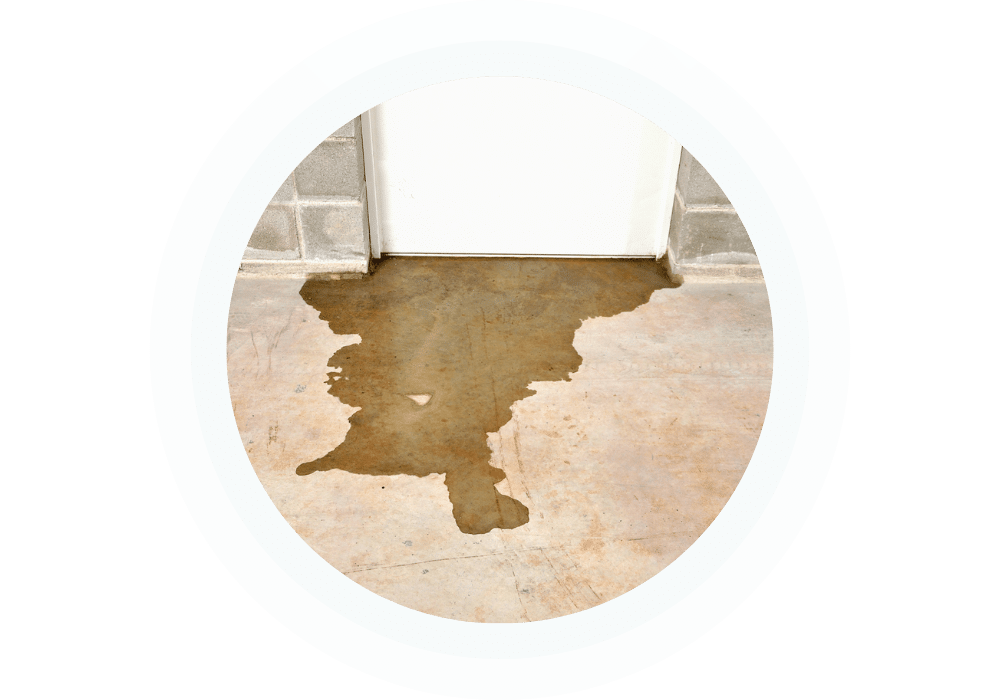

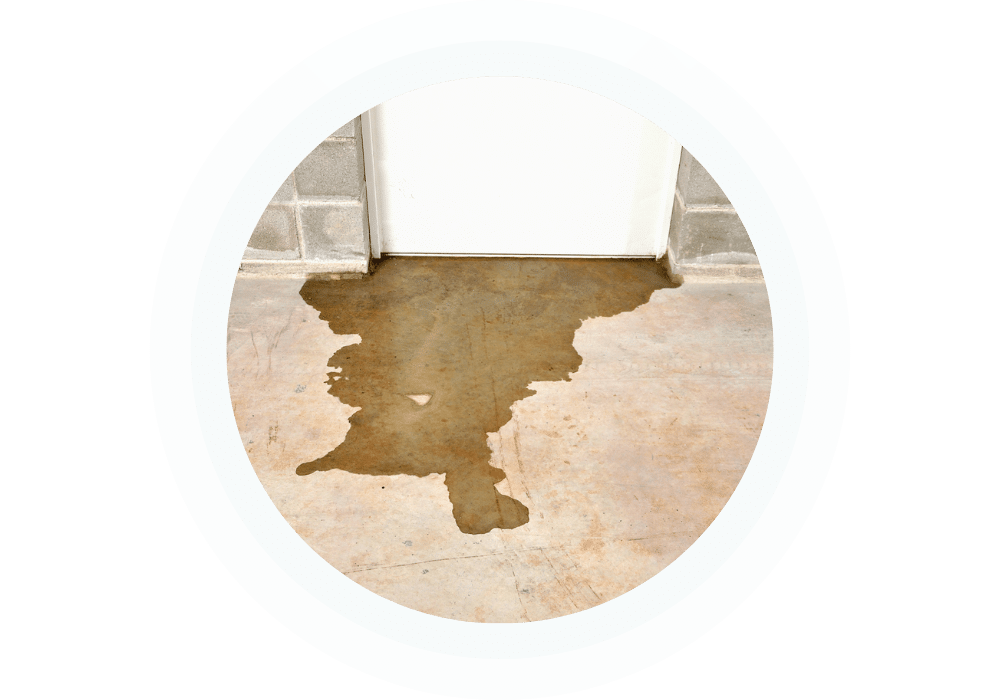

Keep your business from going under water with commercial flood insurance

Even an inch of water can cause thousands of dollars in damages

What is commercial flood insurance?

Flooding can happen as a result of heavy rains or storms, overflow of rivers or streams, melting snow, blocked storm drains, or even mudslides.

Commercial flood insurance reimburses you for damage to your building and business property resulting from a flood. This coverage is typically excluded from a commercial property insurance policy, and must be purchased as a separate policy.

In the case of a flood, Massachusetts flood insurance will cover up to a maximum of $500,000 for your building, and up to $500,000 for your business property

Commercial flood insurance statistics

Don’t underestimate a little water: even if you aren’t in a flood zone, you can be flooded. Get a commercial flood insurance policy before it rains on your business.

What is (and is not) covered by commercial flood insurance?

A commercial flood insurance policy won’t reimburse you for everything. But it will reimburse you for things that aren’t covered by any other insurance policy.

That being said, each policy does have limitations and exclusions that you’ll want to be aware of.

What is typically covered?

Actual cash value coverage (replacement cost less depreciation)

Building foundations

Furnaces / water heaters / fuel tanks

Permanently installed property

Appliances (limited)

Detached garages

Business property inside your building (limited)

Prevention, protection and cleanup costs

Mold remediation (caused by flood damage)

Damage that affects at least two acres of land or two or more properties

What is not typically covered?

Replacement cost coverage

Business vehicles

Personal property

Lost business income

Business property outside of your building

Landscaping

Septic systems

Any damage that affects less than two acres of land or less than two properties

Any damage that occurs during the 30 day waiting period after getting a policy

Got commercial flood insurance questions? We’ve got answers.

Massachusetts flood insurance isn’t required for your business (unless you have a loan and live in a high-risk flood zone), but it is something you should consider. Let us help you decide whether flood protection is right for your business.

Do I need commercial flood insurance?

Most commercial property insurance policies do not provide coverage for damages resulting from a flood. Here are some things to consider when deciding if you need flood insurance for your business:

- Would your business be affected by any flat or downward sloping land, causing water to accumulate?

- Are you in an area that has warm springs and cold, snowy winters?

- Do you have any streams, rivers or large bodies of water near your business?

- Are you located near any dams or levees?

If you answered yes to any of the questions above, you may be at more of a risk for flooding than other businesses, which means flood insurance would be worth looking into.

What if I'm not in a flood zone?

If you’re not in a “flood zone,” you may think you are safe from flooding, but think again. According to FEMA, 25% of flood-related claims are from low to moderate flood risk areas. Simply living in New England creates many opportunities for weather-related flooding. Thankfully though, businesses that are in low risk areas will receive the best pricing for a commercial flood insurance policy.

Read More: Do I Need Flood Insurance Even if I’m Not in a Flood Zone?

Do I have to buy flood insurance from my lender?

No.

If you have a loan, and your business is located in a flood zone, your lender may require you to obtain flood insurance. But you don’t have to buy it from them.

In fact, if you did, it may be more expensive than what an independent insurance agent can provide. Reach out to your commercial property insurance agent to obtain alternative quotes.

If I don’t buy flood insurance, can’t I just get help from FEMA?

If you don’t have a commercial flood insurance policy, FEMA may provide emergency assistance, but only if your location has been declared a disaster area. Reimbursement will be limited to certain coverages and repairs.

In some instances, you may also be eligible for a SBA Disaster Loan.

Even still, commercial flood insurance is the only way to know you'll be covered and don't have to worry about potentially not being eligible for these federal programs.

How flood insurance prevents your business from getting waterlogged

You need your building and everything inside it in order to run your business - otherwise you wouldn’t have them to begin with. Keep them protected with a commercial flood insurance policy.

Disaster protection

Water and snow cause a lot of damage here in Massachusetts. Flood insurance will reimburse you for damages from the elements.

Compliance correction

If your building suffers damage, you may be faced with rebuilding up to newer building codes. Commercial flood insurance provides extra coverage to get you in compliance.

Perks for being prepared

Not many insurance policies pay you to be proactive - but with Massachusetts flood insurance, you can be reimbursed for keeping your property safe before a storm.

Debris removal

Clean-up costs can sometimes be more expensive than damage from the flood itself. Your policy will pay to remove debris from your property after a storm.

Simplifying commercial flood insurance … one blog at a time

Find the answers to all your insurance questions through the helpful resources in our free online Learning Center.

Our clients are like family. See what they are saying...

"We’ve needed to file three claims and in each instance, [Berry Insurance] was very professional, empathetic and handled our claim very quickly."

Get protected, before and after the storm, with commercial flood insurance

Massachusetts flood insurance has a 30-day waiting period - so don’t delay! Simply fill out this form and a member of our commercial insurance team will be in touch.

.png?width=900&height=300&name=How%20to%20Find%20Out%20if%20youre%20in%20a%20Flood%20Zone%20(and%20How%20to%20get%20a%20Flood%20Elevation%20Certificate).png)