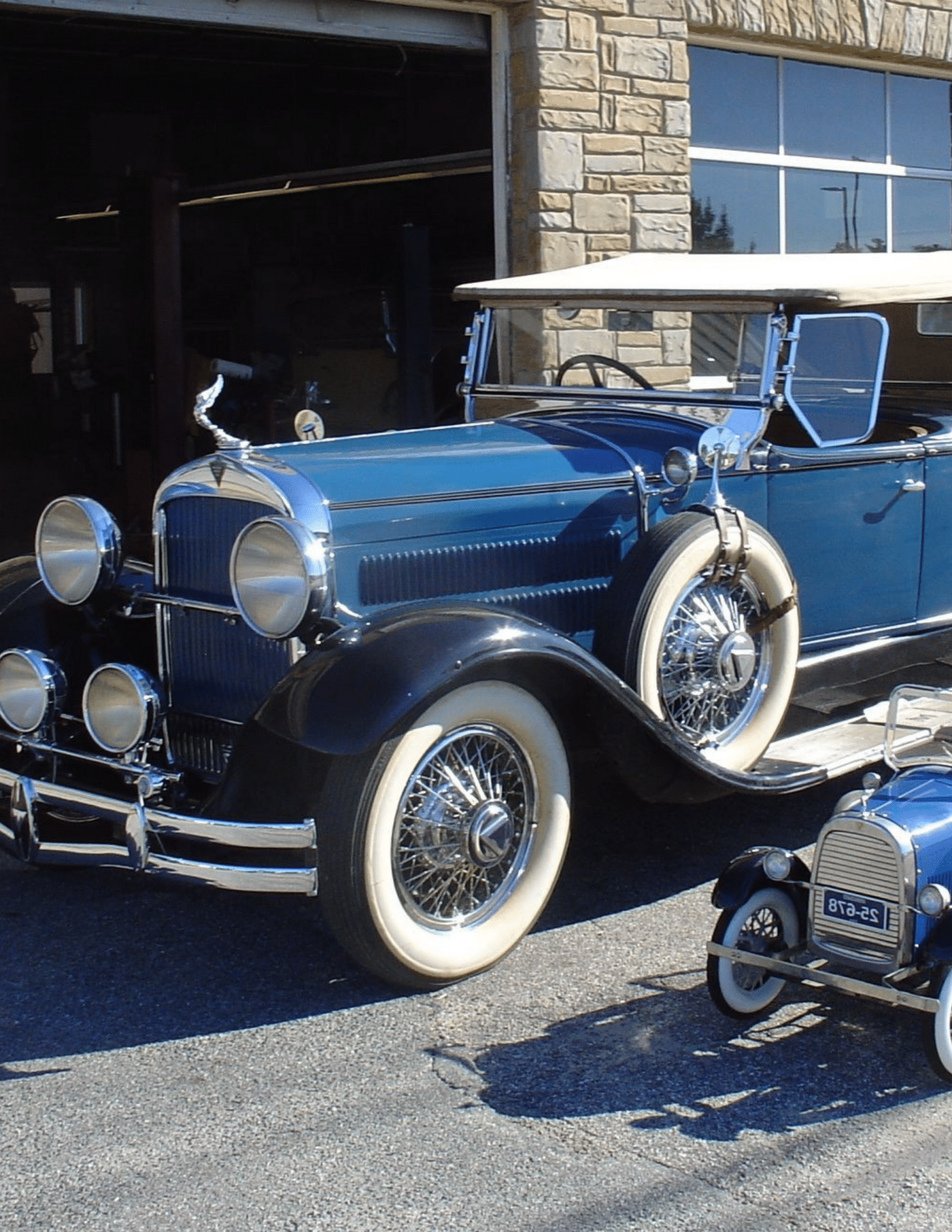

Keep your prized specialty vehicle in mint condition with classic car insurance

Get only the coverage you need at the price you should be paying for your treasured collectible

What is classic car insurance?

Your antique or specialty vehicle isn’t the same as every other vehicle on the road, so it shouldn’t have the same coverage as every other vehicle on the road.

Classic car insurance, sometimes referred to as antique car insurance, is similar to standard car insurance, offering most of the same protections, but it is designed for collectible vehicles that aren’t driven every day. That means it has lower prices and unique services.

Check out these classic car insurance statistics

Classic car insurance might be exactly the protection you need, for a lower price.

What is (and is not) covered by classic car insurance?

While you may think classic car insurance covers everything under the sun that’s related to your vehicle, that’s not necessarily the case. Classic car insurance has limitations, exclusions, and optional coverages you’ll want to know about before hitting the road.

What is typically covered?

Complete coverage for the value of your car

Injuries to someone else for an accident you cause in MA up to policy limits

Medical bills and lost wages for you and your passengers up to policy limits

Any damage done to someone else’s vehicle or property

Coverage if you are involved in a hit-and-run

Coverage if you are hit by an uninsured driver

Damages to your vehicle (optional)

Cars not registered or under reconstruction (including parts)

Injuries to someone else for an accident you cause outside of MA (optional)

Glass or windshield replacement (optional)

Coverage if you are hit by someone with minimal insurance (optional)

Towing (optional)

What is not typically covered?

Vehicles driven daily

Off-road or recreational vehicles

Commercial-use vehicles

Motorcycles with performance modifications

Improperly stored vehicles (in some cases)

Damage from negligence or lack of vehicle maintenance

Personal property in your car

Damages as a result of using your vehicle for business

Intentional bodily injury or property damage

Got classic car insurance questions? We’ve got answers.

We know antique car insurance can be complex. You probably have loads of questions, so let’s get you started on the basics.

How is classic car insurance different from regular car insurance?

Classic car insurance offers most of the same protections as regular car insurance, such as collision, comprehensive, property damage, and bodily injury liability, but is specifically catered to your classic car.

Classic car policies are only intended for occasional vehicle use, so the premiums are much cheaper than a normal policy.

Also, unlike a standard auto policy, your vehicle value does not depreciate. Once your vehicle price is established that coverage amount is guaranteed on your policy.

A classic car policy does not have mileage limitations, whereas, if you listed your classic car under a standard policy, it might be subject to restrictions.

How do I know if my car qualifies for coverage?

Classic car insurance covers a variety of classic cars, trucks and other vehicles, including antiques autos, collector and vintage cars, some modified and newer vehicles, motorcycles, and other specialty vehicles.

Whether or not you qualify depends on usage, driving records, and risk.

You can’t get a classic car policy for a vehicle you have for everyday use, or off-road or recreational vehicles, commercial-use vehicles, motorcycles with performance modifications. In some cases, however, you may be able to insure your everyday vehicle under your classic car policy, if you already have a classic car.

Some policies may even require you to store your car in a garage or similar protection and you may not qualify for a policy if you cannot.

Reach out to your insurance agent to find out if you qualify.

Do I need classic car insurance if I have a classic car?

Technically, no.

But as long as you are driving your classic car at all, you need some sort of car insurance policy. And classic car insurance might make the most sense since it is cheaper than a standard auto insurance policy.

How much does classic car insurance cost?

Classic car insurance can vary significantly based on several factors including your vehicle, coverages and limits, where you live, your driving record, how much you drive, what you use your vehicle for, who drives your car, payment methods, and discount eligibility.

However, the premiums for classic car insurance are on average 36% lower than a standard auto insurance policy, which usually costs somewhere between $700 - $3,000 per year or $58 - $250 per month.

How classic car insurance keeps your ride in mint condition

Your classic car is your baby. You want to protect it with the best policy, paired with convenience and value.

Pay for your use

You don’t drive your classic car every day. You shouldn’t have to pay for insurance as if you did. Classic car policies cost 36% less than a standard auto insurance policy.

Have guaranteed value

Your car’s value doesn’t depreciate under classic car insurance. You help determine your vehicle’s cost and you’re covered in total up to that amount.

Drive at your leisure

You shouldn’t be restricted from driving your car. Under classic car insurance, you aren’t held to a fixed mileage limit (although the amount you drive does influence the cost). You just need to be sure to not drive your car every day.

Simplifying classic car insurance … one blog at a time

Find the answers to all your insurance questions through the helpful resources in our free online Learning Center.

Our clients are like family. See what they are saying…

“I have some unconventional insurance needs and Berry helps me work through them to get the best coverage. They are also very responsive when I call with questions and requests.”

Classic car insurance protection for the road ahead

Don’t get your joyride detoured by uncovered claims. Stay the course with the right classic car insurance policy. Simply fill out this form and a member of our personal insurance team will be in touch.